ABC Pattern .328 1.27: Understanding Key Fibonacci Ratios for Trading Success

ABC Pattern .328 1.27 In the dynamic realm of trading, where every decision can impact profitability, understanding market patterns is crucial for success. Among the various formations that traders analyze, the ABC pattern stands out for its clarity and predictive potential. This pattern is not only recognized for its simplicity but also for its effectiveness when combined with Fibonacci ratios, particularly the .328 and 1.27 levels.

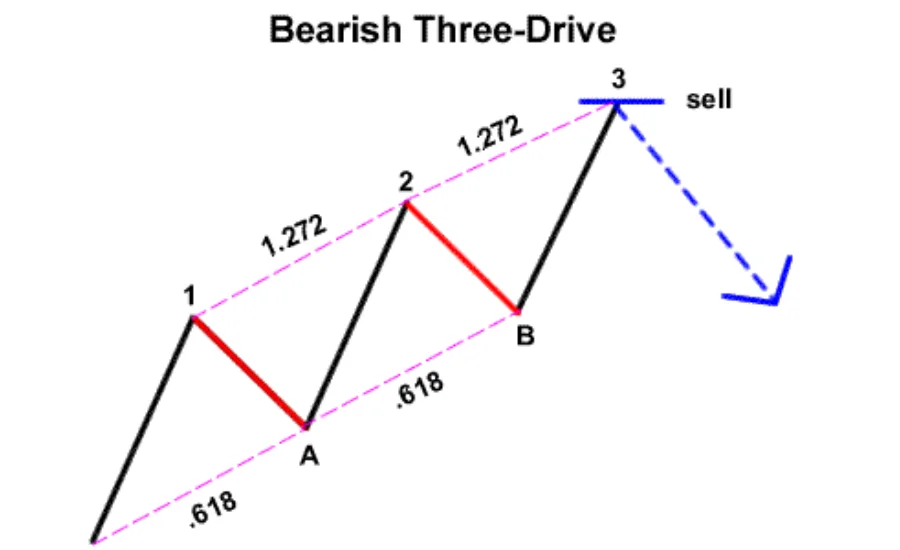

Three crucial points—A, B, and C—that show price fluctuations and possible reversal zones make up the ABC pattern. Trading professionals can learn more about the behavior of the market by including Fibonacci ratios into this framework. While the 1.27 ratio suggests possible price extensions and strong market momentum, the.328 ratio frequently indicates a shallow pullback and suggests a continuation of the dominant trend.

You will learn how to improve your trading techniques and make better decisions in the complex world of financial markets by understanding the ABC pattern and these fundamental Fibonacci levels as we explore their nuances.

Understanding the ABC Pattern .328 1.27: A Key Tool for Traders

The ABC Pattern .328 1.27 is a notable Trading formation that indicates potential price reversals within the market. This pattern comprises three critical components: point A, point B, and point C, each signifying essential price levels that traders closely monitor.

Point A represents the initial peak or trough of a price trend. Following this, the price movement retraces to point B, reflecting a correction in the trend.Point C, which frequently denotes a reversal or a continuation of the current trend, is reached in the next phase. Understanding this ABC structure can help traders make more logical trading decisions based on market data rather than gut feelings. It can also highlight strategic entry and exit opportunities.

The ABC pattern’s efficacy is further enhanced by its synergy with Fibonacci ratios. Traders can improve their comprehension of market dynamics by delving further into possible zones of support and resistance by utilizing the.328 and 1.27 Fibonacci levels. Fibonacci analysis and pattern identification work together to give traders a strong framework for negotiating the intricacies of the financial markets, which in turn leads to more intelligent trading methods.

The Fascinating Origins of Fibonacci Ratios and Their Impact on Trading

ABC Pattern .328 1.27 The famous Italian mathematician Leonardo of Pisa, often known as Fibonacci, is credited with introducing the fibonacci ratios, which have a long and illustrious history dating back to the 13th century. A series of numbers that he revealed in his seminal work “Liber Abaci” has since gained notoriety in mathematical and natural contexts.

The first two numbers in the Fibonacci sequence are 0 and 1, and every number after that is the sum of the two numbers before it. The arrangement of flower petals, seashell spirals, and pine cone structure are just a few examples of the profound yet simple pattern seen throughout nature that exemplifies the inherent beauty of mathematics.

Fibonacci ratios were important to traders when they started to study the financial markets because they could be used to determine crucial price levels for retracement and extension. The most often utilized ratios that can be obtained from this sequence are.382,.236 and.618 (also known as the golden ratio). These proportions are now essential tools for traders who want to forecast market movements and make wise choices.

Fibonacci tools are now considered essential in technical analysis due to growing awareness of their benefits. They are a vital instrument in the toolbox of contemporary traders because of their broad use that transcends simple mathematics and bridges the gap between quantitative analysis and the innate patterns that govern our universe.

Exploring the Essential Elements of the ABC Pattern .328 1.27

Grasping the fundamental components of the ABC Pattern .328 1.27 is vital for traders aiming to leverage its potential effectively. This pattern comprises several key elements, each contributing significantly to its overall functionality in trading strategies.

Structural Framework of the ABC Pattern .328 1.27

The structural framework of the ABC Pattern is designed to withstand various market challenges, ensuring reliability during price fluctuations. By understanding this framework, traders can better anticipate price movements and make informed decisions.

Materials and Tools for Implementation

The implementation of the ABC Pattern .328 1.27 relies on specific analytical tools and methodologies that enhance its effectiveness. These tools provide traders with the necessary insights to identify trends and reversals in the market, leading to more strategic trading choices.

Advantages of Utilizing the ABC Pattern .328 1.27

Employing the ABC Pattern .328 1.27 presents numerous benefits that enhance trading outcomes. Among these advantages are:

Competitive Edge

Compared to other trading models, the ABC Pattern .328 1.27 offers distinct advantages in identifying potential reversals and trends. This pattern allows traders to make more accurate predictions, giving them an edge in the fast-paced trading environment.

Cost-Effectiveness and Performance

When evaluated against industry benchmarks, the ABC Pattern .328 1.27 consistently demonstrates superior performance in terms of cost-effectiveness and trading efficiency. By optimizing trading strategies, this pattern helps traders maximize their returns while minimizing risk.

Understanding and applying the ABC Pattern .328 1.27 equips traders with a powerful tool for navigating the complexities of financial markets, ultimately leading to more informed and profitable trading decisions.

Mastering Fibonacci Level Calculations for Effective Trading

Calculating Fibonacci levels can enhance your trading strategy once you understand the underlying principles. To begin, identify a significant price movement on your asset’s chart, such as a peak or trough. This initial swing sets the foundation for your analysis.

Once you have identified these points of importance, measure the distance between them. This distance will be your starting point for any more computations. Once you have this baseline established, use the fundamental Fibonacci ratios: 23.6%, 38.2%, 50%, 61.8%, and sometimes 78.6%. You can identify probable levels of support and resistance in the market by multiplying the recorded distance by each of these ratios.

Next, add or subtract these computed values from your beginning point according to which way the price movement you are evaluating is going—upward or downward. This step will help you determine where price corrections may occur.

Once you have identified these levels, mark them clearly on your chart. These Fibonacci levels can offer valuable insights into possible reversal points or areas where the trend may continue.

It’s also beneficial to experiment with different time frames, as the effectiveness of these levels can vary significantly between day trading and long-term investment strategies. By applying these techniques, you can develop a deeper understanding of market behavior and enhance your trading decisions.

Understanding the Significance of .328 and 1.27 Fibonacci Ratios in Trading

The .328 and 1.27 Fibonacci ratios play a vital role in the trading world, serving as key indicators for potential market reversal points. These ratios stem from mathematical relationships that are not only present in financial markets but also found in various aspects of nature, which makes them intuitive for traders to apply.

The ABC Pattern .328 ratio reflects a pullback of approximately 32.8% from an initial price movement. This slight retracement suggests a potential pause before the trend continues, offering traders an opportune moment to identify buying or selling prospects based on market dynamics.

Conversely, the 1.27 ratio represents an extension that exceeds the original price movement by about 27%. This ratio acts as a robust tool for forecasting future price targets, particularly when market momentum begins to shift.

By adding these Fibonacci ratios to your trading technique, you may improve your approach and make better decisions when the market is volatile. To properly capitalize on new trends, one must have a firm grasp of how these ratios relate to price changes. By recognizing these levels, traders can enhance their ability to navigate the complexities of the market effectively.

Mastering the Application of Fibonacci Ratios in Trading Strategies

Understanding Fibonacci ratios is just the foundation for effective trading; successfully integrating them into your overall strategy is essential for maximizing their potential.

Begin by pinpointing critical support and resistance levels on your charts. These levels are often where price reversals occur, making Fibonacci retracement levels particularly valuable in your analysis. Recognizing these zones can provide insights into potential market behavior.

Stay vigilant regarding current market trends. When the prevailing trend aligns with a Fibonacci level, it often indicates a heightened likelihood of reversal or continuation, offering traders strategic entry and exit points.

Incorporate additional technical indicators, such as moving averages and volume analysis, to complement your use of Fibonacci ratios. This multi-dimensional approach not only validates your trading decisions but also enhances your ability to navigate market fluctuations confidently.

Patience is key in trading. Wait for clear signals that align with Fibonacci levels before executing any trades. Rushing into decisions without sufficient confirmation can lead to unnecessary losses.

Finally, maintain a record of your historical performance when applying Fibonacci ratios. Analyzing past trades will help you learn from your experiences, enabling you to refine your strategy and improve your decision-making process over time. By thoughtfully combining these elements, you can elevate your trading effectiveness and achieve more consistent results.

Read More: How SECURE Act 2.0

Final Words

Incorporating Fibonacci ratios into your trading strategy can significantly elevate your decision-making process and improve your overall trading outcomes. The ABC Pattern .328 1.27 provides a structured framework for analyzing price movements, leveraging the inherent order found in market dynamics.

Many traders appreciate the reliability that Fibonacci levels offer. By understanding and recognizing these patterns, you can pinpoint potential reversal points and identify trend continuations with increased precision. This predictive quality can instill confidence in your trading decisions.

Integrating Fibonacci analysis with other technical indicators creates a robust toolkit for navigating the complexities of the financial markets. However, it’s essential to remain adaptable, adjusting your strategies in response to shifting market conditions.

As you deepen your trading knowledge and experience, allow Fibonacci ratios to inform your choices and reinforce your confidence in every trade. Embracing this mathematical framework can lead to more insightful decisions and, ultimately, more favorable results in your trading pursuits.

For More Information Check It Out Washington Breeze